The Australian market found renewed strength at the start of the month, looking set to build on the consolidation seen in October.

Backed by strong Australian economic data, which in turn was supported by positive International economic numbers particularly emanating from China and the US, commodities found strength, resulting with the big end of town resource stocks performing well throughout November with BHP up 6.85 %, and RIO climbing 7.2 %.

Consequently the resource sector XJR gained 5 % for the month of November, and other sectors such as the Info Tech XIJ up 11 % and Consumer Discretionary Sector, XDJ also experienced strong buying, gaining 4.7% for November. Health care, XHJ continued on its phenomenal trend to be up another 9% for the month, with a total gain year to dat of 46%.

However it wasn’t all smooth sailing for the market, with US/China trade deal anxiety creating a 2 day pull back, with the market losing over 140 points from the 20th – 21st, before renewed optimism set the market on a 5 day winning streak culminating with the ASX 200 reaching an all time high on the 28th.

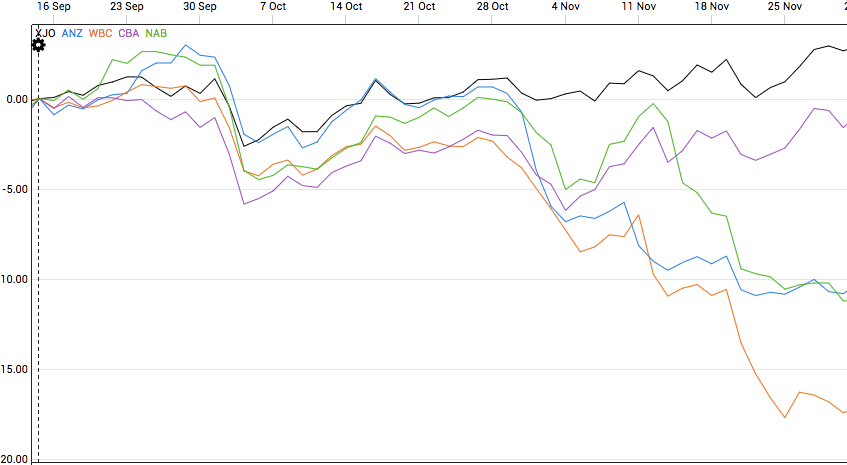

In addition the Financials XFJ which was down 3.5% for November, as can be seen by the chart below weighed on the market. The Financials XFJ Index, is being buffeted by two key factors one of which is certain and in the present with the second being uncertain in regard to the full impact potentially yet to be seen in the share price, with 3 of the big 4 in a race to the bottom.

The banking sector having digested both a change of culture and also the ramifications of the Banking Royal commission, have seen both profits deteriorate dramatically, and in some cases dividends being reduced, both of which makes Institutional Investors nervous.

Potentially the greater concern of legal issues yet to totally materialise, manifested this month when Westpac was accused by AUSTRAC of breeching Anti Money laundering and counter terrorism laws. This impacted several of the banks dramatically, with only 1 of the big 4 banks finishing higher for the month.

- WBC : -13%

- ANZ: -10%

- NAB : – 9.5%

When compared with the ASX200 below, one can see the true extent of the fall for the banks.

KEY ECONOMIC DATA

- RBA held rates @ .75%

- Australian Trade Surplus Expanded to $7.18B

- Australian Unemployment rate 5.3%

- Australian Construction Industry Continued to contract

- China retail sales grew 7.2%

DOW JONES IND AVG 27,142 – 28,051:UP 909

Data Trumps Fear

DJI 12 MONTH CHART

The unrelenting and sustained stream of positive economic data literally overwhelmed the bears as the market continued with the stamped, hitting no less than 9 all time highs in the first 18 sessions of November.

The three key elements that propelled the market.

- Strong Employment Data

- Market Beating Company profit reports

- Strong Macro Economic Data

Even with the party stopping on the 19th, over concerns emerging once again regarding the implementation of the US/China Phase 1 trade deal, the market only pulled back marginally dropping back 312 points, before buying came back into the market once again pushing the market to consecutive all time highs to close at 28.164, on the 27th leading into the Thanksgiving holiday’s, before ending the month at 28,051.

Key Economic Events and Indicators

- US unemployment inched higher 3.6 %

- Federal Reserve shifted to Neutral Stance (suggesting no more Interest rate cuts)

- US trade deficit unexpectedly narrowed to $52.5 b

- Walmart beat Market earnings beat market expectations for 3 consecutive qtr

- Existing home sales jumped 1.9% :Beating Market Expectations

- Durable Goods Orders : Beat Market Expectations

- US GDP beat market expectations with 3rd Qtr (2.1%)

OIL PRICE UPDATES: All Quiet on the Middle Eastern Front

WTI Crude – Gained $1.26 : $54.16 – $ 55.42

November started positively, with stronger than expected economic data both from China and US pushing prices up for the first week. However a blow out in US Crude Oil inventories, which came in 5 times more than what the market expected created a session $2 drop on the 7th.

From a Middle East perspective, a fairly quiet month without anyone bombing anyone ensured the International Oil market primarily focused on US / China trade negotiations, and whims of Trumps tweets.

Consequently, the Oil market experienced some wild swings throughout the remainder of the month, particularly from the 18th to the 21st, which saw an initial brutal 5% drop, only to be followed by a 6.3 % session bounce.

The market then settled into a channel, until once again concern about the Phase 1 US/China trade deal falling apart induced a route on the final day, with a 4.5% session fall, to close the month at $55.42

Key Oil Price Influences

- Civil unrest spread in Iraq, with open rioting on the streets.

- Iranian Soldiers patrolling Tehran following violent outbreaks over decreased fuel subsidies.

- US Crude Inventories jumped massively, exceeding expectation by 5 times.